RAVEN INDIGENOUS OUTCOMES FUND

Making first-of-their-kind investments that improve outcomes in Indigenous communities.

At Raven, we believe that transformational change and outcomes require rethinking how we address social problems. Our outcomes finance model places Indigenous communities, knowledge, and values in the drivers seat of the change they aim to achieve.

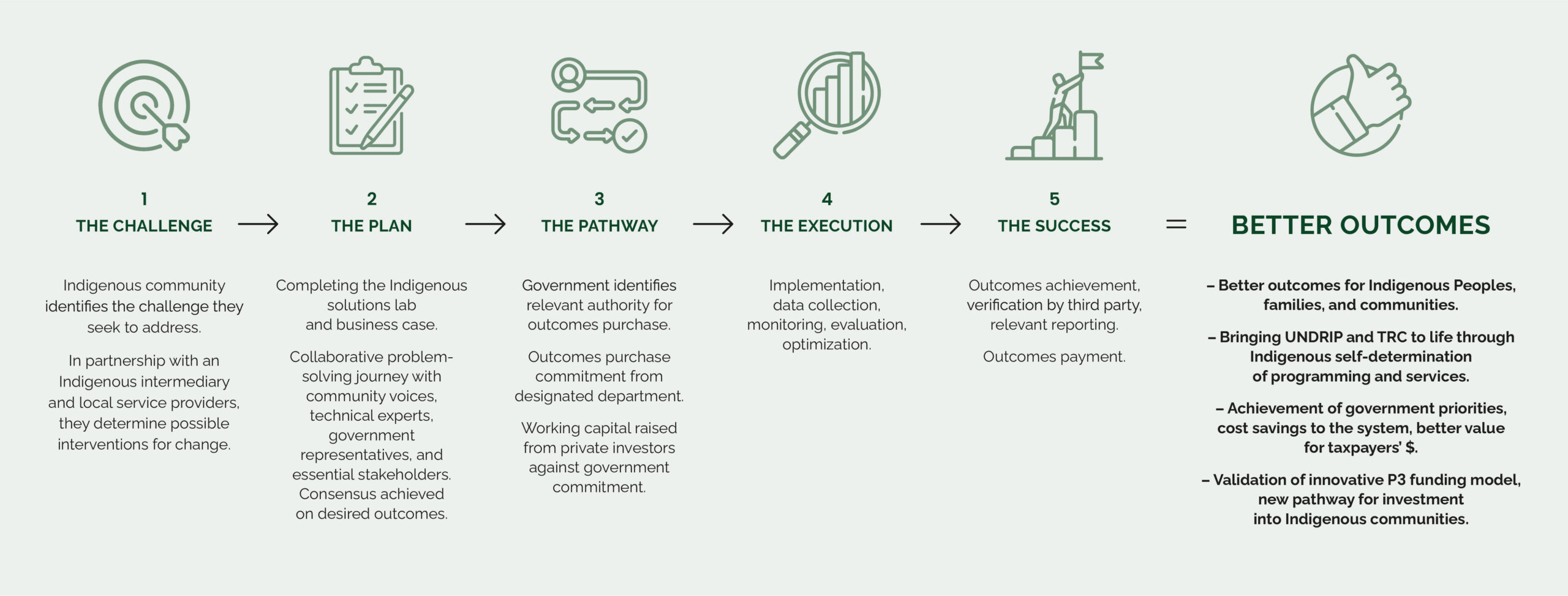

The Raven Indigenous Outcomes Fund offers investors the opportunity to deploy capital to scale meaningful social programs and improve outcomes in Indigenous communities, while allowing government to only pay for what works. Indigenous outcomes-based financing deals, what we call CDOCs or Community-Driven Outcomes Contracts and what others refer to as pay-for-success/performance projects, align social impacts and financial returns.

Specifically pertaining to UNDRIP Articles Three and Twenty-one, Raven is working to improve economic and social conditions of Indigenous Peoples on Turtle Island. Investing in Indigenous communities is an act of economic reconciliation.

We use innovative financial pathways within the social finance ecosystem to create actionable priorities for economic reconciliation and actioning UNDRIP. In this way, we are rethinking how we address social problems in our communities and making lasting change.

OUTCOMES FINANCE AT RAVEN

STRATEGY

We use innovative financial pathways within the social finance ecosystem to create actionable priorities for economic reconciliation and actioning UNDRIP. In this way, we are rethinking how we address social problems in our communities and making lasting change.

OPPORTUNITIES

The team has identified promising, intersecting sectors, including:

- Health (T2D reduction)

- Climate adaptation and clean energy

- Workforce development

- Chronic homelessness

Outcomes Project Profiles

Community Driven Outcomes Contract Model

SEEING TWO-EYED OUTCOMES

Our work starts and finishes with the outcomes our partner communities are seeking.

Our measurement system marries Indigenous and Western value systems to articulate a holistic impact narrative to drive new appreciation and, ultimately, improved valuation of self-determined Indigenous outcomes.

Fund prospectus

STRUCTURE

A 5 (+1+1) year GP/LP fund that supports transformative outcomes in Indigenous communities.

- Targeted Indigenous deal pipeline,

- Capital recycling,

- A blended finance structure where the majority of carried interest is reinvested into the Raven Foundation, where CDOCs are developed and carried to implementation.

DEAL PIPELINE ACCESS

We leverage an extensive network in Indigenous communities in public, private, and social sectors.

We lean into our intermediary ability to work closely with technical advisors, service providers, and across local, provincial, and federal governments to source reliable investment opportunities and nurture supportive procurement pathways.

INDIGENOUS LEADERSHIP

The Fund is led by Raven, and within that by Jeff Cyr, an impact investor with experience in developing funds, managing public-private partnerships, and outcomes-based financing, who led the 1st such CDOC financing in Canada (Raven Indigenous Community Outcomes $ 7.5 M). This is combined with over 25 years of public-private-non-profit Indigenous leadership. A robust outcomes finance team has been carefully curated and is supported by Raven’s leadership team.

RISK MITIGATION

The Fund expects to provide diversified exposure across geography, issue area, and service providers, targeting Indigenous initiatives that demonstrate character, hold a strong track record and the capacity to successfully scale. Dual interest class structure provides a degree of downside protection for investors who subscribe for the Class A limited partnership interests of the Fund.

BROAD ADVISORY NETWORK

The management team’s access to thought leaders with backgrounds across impact investing, public policy, and government innovation contributes to critical market knowledge and industry experience relevant to deal structuring and asset management.

PROSPECT ANCHOR INVESTMENTS

Raven is working with Social Finance Fund wholesalers to secure a potential tranche of initial, subordinated share class catalytic capital ($10 – $12 M CAD)

Fund Terms

$50M Target Raise

| Fund Type |

GP/LP Structure Class A – Senior Class B – Subordinated |

| Hurdle Rate/Carried Interest (80/20) |

4% Hurdle 50% Carried interest allocation to Foundation |

| GP Commitment | 0% |

| Fund Life |

5 + 1 + 1 years Capital recycling (20% cap) |

| Target IRR (Net) | 4 – 7% |

| Investment period | 4 years from final close |

| Management Fees | 1.75% |

Why invest with Raven

- The Raven Indigenous Outcomes Fund represents a unique opportunity to drive self-determined and owned Indigenous programming with risk adjusted, market-rate financial returns alongside a transformational impact narrative. Not to mention, building and managing Indigenous funds is our bread and butter.

- The cultural, creative, and economic strength of Indigenous Peoples is needed to innovate and shape solutions to critical challenges across North America.

- Raven doesn’t just serve Indigenous communities — it is Indigenous. More than 75 percent of staff are Indigenous ; more than 50 percent of staff are female or non-binary.

- Economic reconciliation occurs when Indigenous Peoples are no longer managing poverty but are managing wealth.

We invite innovative and passionate investors to join us in our shared vision for improved outcomes for Indigenous Peoples.

We look forward to hearing from you.

Jeff Cyr, CEO

jeff@ravencapitalpartners.com

Rebecca Waterhouse, Principal

rebecca@ravencapitalpartners.com